Navigating tax regulations and compliance can be overwhelming for businesses managing indirect taxes. In Dynamics 365 Finance and Operations (D365FO), mastering indirect tax management is key to operational excellence and a competitive edge. This post highlights the importance of indirect taxes in Dynamics 365 F&O, features for tax management, and best practices to streamline processes.

Exploring Indirect Taxes in Dynamics 365 Finance and Operations

In an ERP system like Dynamics 365 Finance and Operations, indirect taxes go beyond the costs of items and services. They affect pricing, customer trust, cross-border trade, and more. D365FO users face indirect taxes in various forms:

- Sales Tax: Imposed by state or local governments on goods and certain services.

- Value-Added Tax (VAT): A consumption tax levied at each supply chain stage, with tax credit for inputs.

- Goods and Services Tax (GST): Similar to VAT but applied globally, e.g., in Australia, Canada, and Singapore.

Understanding and managing these taxes is vital for legal compliance and financial transparency in operations. Dynamics 365 Finance and Operations is equipped with features to ease tax management and reporting.

Key Features for Tax Management

There are many key features to be aware of as it relates to tax management. The following features are important to note:

- Tax Groups: A set of taxes applied to goods or services in a transaction. Tax rates can be defined by customer, vendor, product, or specific entities.

- Tax Codes: Reference codes for tax types or groups used in ledger transactions and financial statements.

- Tax Integration: Tax calculation is integrated into D365FO sales, purchase, and accounting modules to reflect taxes in transactions and financial reporting.

- Tax Jurisdictions: Sales tax varies with states or regions. D365FO has a built-in tax table for US jurisdictions that supports additional configuration.

- Tax Exemptions: Some goods or services, e.g., healthcare, may be exempt from tax. D365FO allows managing exemptions by customer, product category, and region.

- Tax Reporting: Tax transactions are tracked in the system to generate reports for filing returns or audits.

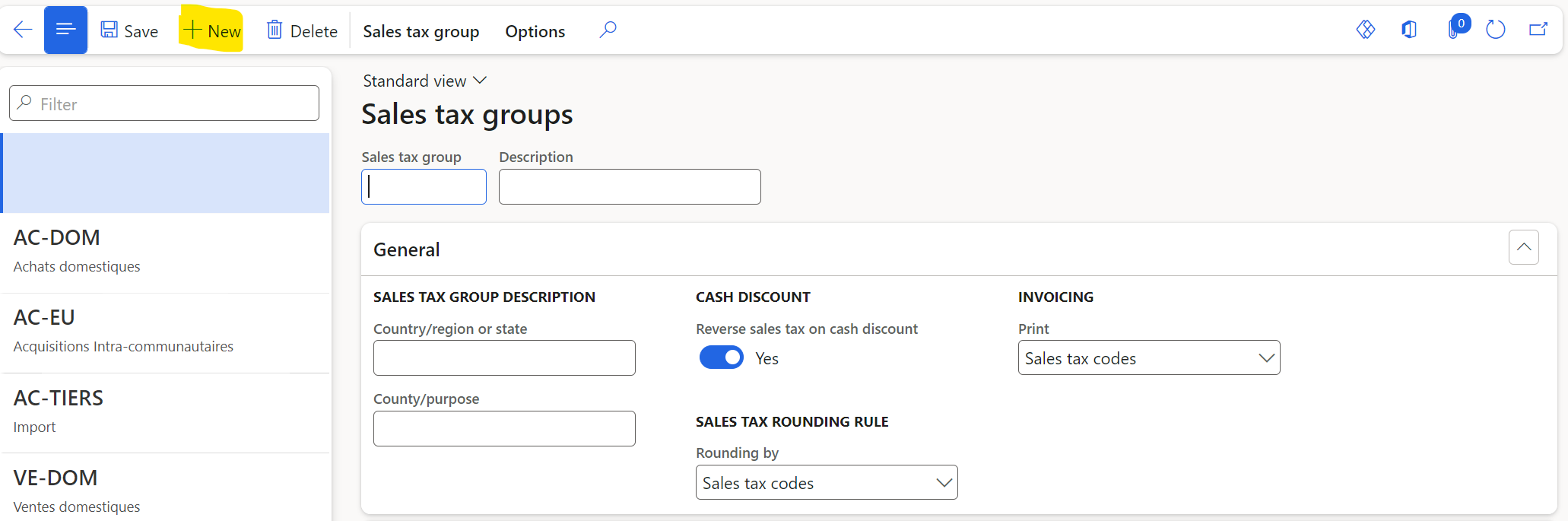

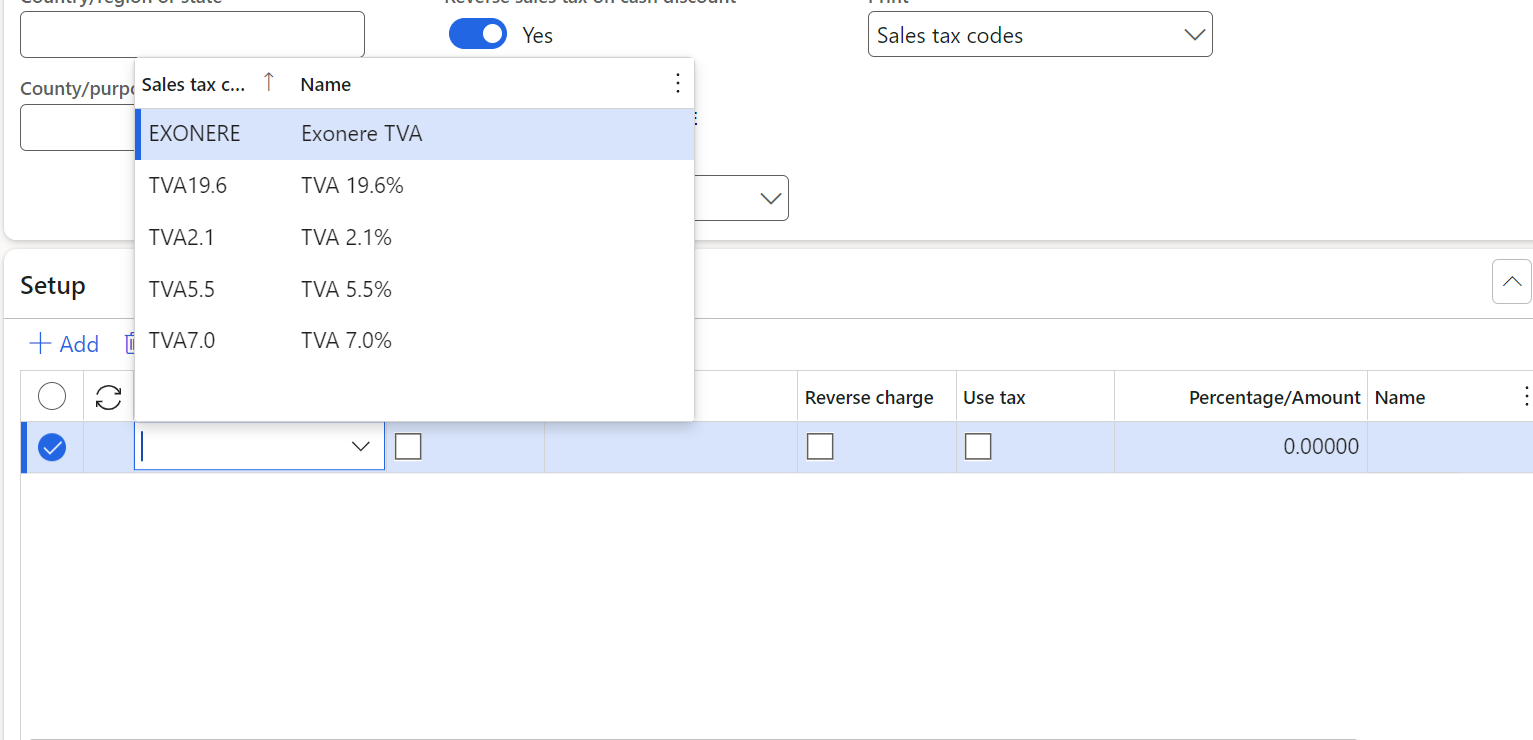

Setting Up a Tax Group in Dynamics 365 Finance and Operations

Creating a Tax Group in Dynamics 365 for Finance and Operations is a straightforward process that ensures accurate tax application across transactions. To set up a new Tax Group, follow these steps:

1. Navigate to Tax > Setup > Sales tax > Sales tax groups.

2. Select +New to create a new group. Enter a unique name and description that clearly identifies the purpose of the tax group.

3. Within the sales tax group form, add the applicable taxes by selecting +Add. Search for and select the appropriate Sales tax codes that should be included in this group.

4. For each tax code added, you can specify further details, such as whether the tax is recoverable and the percentage of tax recoverable if applicable.

5. Once all relevant tax codes are added, and their details are correctly configured, save the group.

By setting up Tax Groups, you ensure that the correct combination of taxes is applied consistently to transactions, streamlining the tax management process and ensuring compliance with local and international tax regulations.

Setting Up a Tax Code in Dynamics 365 Finance and Operations

After establishing Tax Groups, setting up individual Tax Codes is the next critical step in configuring the tax management system within Dynamics 365 for Finance and Operations. A Tax Code represents a specific tax rate and type that can be applied to transactions. Here’s a simple guide to creating a Tax Code:

- Go to Tax > Setup > Sales tax > Sales tax codes.

- Click New to initiate the creation of a new Tax Code. Enter a code identification and a descriptive name to help users understand what the tax code is used for.

- Specify the Tax Type to determine how the tax code should be calculated, such as a percentage of the sales price or a fixed amount.

- Input the tax Rate. If it’s a percentage-based tax, enter the percentage rate; for fixed amount taxes, enter the amount directly.

- If applicable, set the Valid From and Valid To dates to define the period during which the tax code is active. This is especially useful for taxes that undergo periodic updates.

- Advanced settings like Tax Exempt Numbers, Reverse Charge, and Settlement Periods can be configured to meet specific tax compliance requirements.

![A screenshot of a computer

Description automatically generated]()

- Save the newly created Tax Code.

By meticulously setting up each Tax Code, businesses can accurately automate tax calculations in D365FO, ensuring that every transaction is compliant with local and global tax regulations.

Setting Up Tax Exemptions in Dynamics 365 Finance and Operations

To set up tax exemptions in Dynamics 365 for Finance and Operations, businesses can follow these steps to ensure that certain transactions are appropriately exempt from taxes according to legal and organizational policies:

- Navigate to Tax Setup: Go to Tax > Setup > Sales tax > Sales tax exemptions.

- Create a New Exemption: Click + New to add a new tax exemption. Assign it an intuitive code and description that clearly identifies the exemption criteria and purpose.

- Define Exemption Criteria: Under the General tab, specify the criteria for the exemption, such as customer group, item group, or specific transaction types. This will determine which transactions qualify for the exemption.

- Set Validity Period: If the exemption is only valid for a certain period, use the Valid From and Valid To dates to define this. This ensures that the exemption is automatically applied only within the specified timeframe.

- Associate with Tax Codes: Link the exemption to specific tax codes to indicate which taxes the exemption applies to. This is crucial for ensuring accurate calculation and reporting.

- Customer and Product Linking: Optionally, associate specific customers or products with the exemption. This step is necessary for exemptions that apply to specific entities or items.

- Save and Test: Once all details have been accurately entered, save the changes. It’s advisable to test the exemption in a non-production environment to ensure it works as intended and does not negatively affect other tax calculations.

- Documentation and Compliance: Keep detailed records of all exemptions and the rationale behind them. This is important for compliance purposes, especially if audited by tax authorities.

By adequately setting up tax exemptions in Dynamics 365 Finance and Operations, companies can ensure that certain sales, purchases, or transactions are accurately exempt from taxation, aligning with legal requirements and organizational policies. This prevents unnecessary tax charges and ensures compliance with tax laws.

Setting Up Tax Reporting in Dynamics 365 Finance and Operations

To ensure accurate and timely tax reporting in Dynamics 365 for Finance and Operations, businesses should carefully configure their tax reporting settings. The following steps can help in setting up Tax Reporting:

- Access Tax Reports: Navigate to Tax > Declarations > Sales tax > Sales tax reports. This area allows you to access different formats and types of tax reports depending on your business needs and jurisdictional requirements.

- Select the Report Type: Choose the appropriate report type according to the tax reporting requirements of your jurisdiction. D365FO supports various report formats to accommodate different local, state, and international tax laws.

- Configure Reporting Periods: Define the reporting periods for your tax reports under Tax > Setup > Sales tax > Settlement periods. These periods should align with your tax reporting obligations, whether monthly, quarterly, or yearly.

- Allocate the Sales Tax Groups: Ensure that your sales tax groups are correctly configured and associated with the applicable tax jurisdictions. Accurate allocation is crucial for generating precise tax reports that reflect the taxes collected and owed across different jurisdictions.

- Run the Report: Execute the tax report for your selected period and review the generated data to ensure accuracy. The report will detail the taxes collected, taxes owed, and any discrepancies that need attention.

- Review and Submit: Carefully review the completed tax report for any errors or inconsistencies. Correct any issues before finalizing the report for submission to the relevant tax authority.

- Automate Report Submissions: Explore the possibility of automating tax report submissions if supported by your jurisdiction. D365FO can integrate with various e-filing systems, enabling seamless electronic submission of tax reports.

- Record Keeping: Maintain records of all tax reports and documentation for the required period as stipulated by the tax authorities. This is crucial for audit purposes and for maintaining compliance with tax laws.

By following these steps to set up tax reporting in D365FO, businesses can streamline their tax reporting process, ensuring compliance with tax regulations while minimizing manual efforts and the risk of errors.

Best Practices for Indirect Taxes

With indirect taxes in Dynamics 365 Finance and Operations, there are several best practices businesses can follow to reduce the risk of error or non-compliance. A few of which include:

- Stay Compliant: Stay up-to-date with tax laws and regulations in all jurisdictions where the business operates. This includes frequent reviews and updates to tax setups, exemptions, and reporting.

- Maintain Accurate Data: Ensure that data related to sales, purchases, and taxes within D365FO is accurate and up-to-date. This requires regular reconciliations with external sources such as bank statements or vendor invoices.

- Document All Changes: Keep detailed records of any changes made to tax settings, exemptions, or reporting formats. This is crucial for audit purposes and provides a clear trail of all modifications.

- Test Before Deploying: Always test any changes to tax setups or reports in a non-production environment before deploying them to the live system. This minimizes the risk of errors and disruptions to business operations.

- Regularly Review Tax Codes: Regularly review and update tax codes to ensure they accurately reflect the applicable taxes in various jurisdictions. This is especially important when new tax laws or rates are introduced.

- Utilize Automation: Explore automation options available within D365FO, such as setting up recurring tasks for tax reporting, to streamline processes and minimize manual efforts.

- Train Users: Provide adequate training to users responsible for tax-related tasks within D365FO. This ensures that they are knowledgeable about the system and can accurately perform their duties.

- Utilize External Resources: Consider utilizing external resources, such as tax experts or consultants, to assist with complex tax setups or changes. Their expertise can help ensure compliance and accuracy in tax reporting.

It is important to stay updated with changing tax laws and regulations, maintain accurate data and documentation, regularly review and test configurations, and utilize automation and external resources where necessary. This will help businesses ensure efficient tax reporting and compliance in D365FO, ultimately contributing to their overall financial health and stability.

Furthermore, it is essential for businesses to prioritize proper tax management within D365FO to avoid any potential legal or financial consequences. With careful setup and diligent maintenance of tax settings and reports, companies can effectively manage their indirect taxes while staying compliant with tax laws.

Understanding indirect taxes in Dynamics 365 for Finance and Operations is an ongoing journey of learning and adaptation. By utilizing the features and best practices highlighted in this post, businesses can not only ensure compliance but also establish a competitive advantage by efficiently and accurately managing their indirect tax responsibilities. For D365FO users, the key takeaway is clear: prioritize understanding and optimizing your indirect tax processes – the rewards will be substantial.

The post Unpacking Indirect Taxes in Dynamics 365 for Finance and Operations appeared first on Dynamics Communities.